Following robust growth of 5.6% in 2022, economic activity is expected to slow down to 2.3% and 2.7% in 2023 and 2024 respectively amid persistent inflationary pressures and rising interest rates. After peaking in 2022 at 8.1%, inflation is set to abate as global energy prices moderate and supply chain disruptions ease, notwithstanding upward pressures coming from a partial indexation of wages. The labour market is proving resilient. Cyprus is forecast to maintain a government budget surplus over the forecast horizon, while the public debt is expected to continue decreasing, to 72.5% of GDP in 2024.

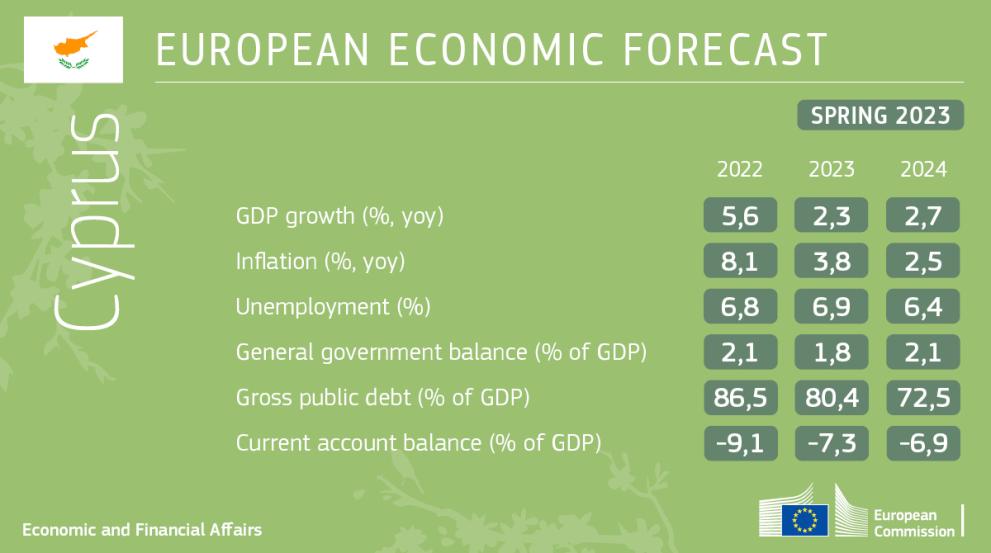

| Indicators | 2022 | 2023 | 2024 |

|---|---|---|---|

| GDP growth (%, yoy) | 5,6 | 2,3 | 2,7 |

| Inflation (%, yoy) | 8,1 | 3,8 | 2,5 |

| Unemployment (%) | 6,8 | 6,9 | 6,4 |

| General government balance (% of GDP) | 2,1 | 1,8 | 2,1 |

| Gross public debt (% of GDP) | 86,5 | 80,4 | 72,5 |

| Current account balance (% of GDP) | -9,1 | -7,3 | -6,9 |

Slow down after 2022 solid growth

Real GDP increased by 5.6% in 2022, driven mostly by domestic demand. Private consumption expanded strongly due to pent up demand following the pandemic and to a significant employment increase. A buoyant influx of foreign investment in real estate pushed up investment in construction. Tourism performed better than expected, despite the loss of the Russian market, and reached about 90% and 80% of the pre-pandemic levels, in revenue and arrivals respectively. Other exports of services such as ICT, financial and professional services continued to expand, also rendering the economy less dependent on tourism.

The slowdown of economic activity started in the last quarter of 2022, and it is expected to continue through 2023. The economy is set to be dampened by the still high inflation eroding the purchasing power of households, by higher interest rates negatively affecting investment, and by weakening growth momentum in Cyprus’ trading partners affecting external demand. The partial indexation of wages implemented in January 2023 is set to somewhat cushion the negative impact on consumption. The implementation of the Cypriot Recovery and Resilience Plan is expected to support investment, notably in construction and equipment, over the forecast horizon. Tourism and other export-oriented services are projected to continue growing, albeit at a slower pace. Overall, real GDP is forecast to grow by 2.3% in 2023, before somewhat picking up at 2.7% in 2024.

Labour market is improving

Robust economic growth pushed up employment by 2.9% and hours worked by 4.1% in 2022. The unemployment rate decreased more than initially expected, to 6.8% in 2022, down from 7.5% in 2021. It is forecast to slightly increase in 2023 to 6.9%, in line with the slowdown of GDP growth, before declining to 6.4% in 2024 as labour-intensive services sectors are set to continue expanding.

Inflation to moderate in 2023

Inflation reached a peak of 8.1% in 2022 on the back of soaring global commodity prices. As global energy prices are moderating and supply chain disruptions are phasing out, inflation is expected to abate to 3.8% in 2023. However, the partial indexation of wages is set to have some secondary upward effects. The expected moderation of global energy and other commodity prices is projected to reduce inflation further to 2.5% in 2024.

Projected budgetary surpluses, while downside risks remain

In 2022, the government headline balance turned into a significant surplus, reaching 2.1% of GDP. The fiscal performance was stronger than expected, supported by buoyant revenue increases driven by the continued economic growth, combined with the withdrawal of COVID-19 support measures.

The budget is forecast to remain in surplus at 1.8% of GDP in 2023. Government revenue is supported by the continued strong performance of private consumption, corporate earnings growth and wage increases. Increases in public wages and pensions are putting upward pressure on expenditure. This forecast assumes that the measures to mitigate the economic and social impact of high energy prices on household energy bills – amounting to 0.4% of GDP in 2023, compared with 0.7% in 2022 – will be fully phased out at the end of June 2023. Budgetary developments in 2023 are also affected by the assumed complete phasing out of COVID-19 emergency temporary measures, which are estimated to have amounted to 0.3% of GDP in 2022.

For 2024, the budget surplus is expected to reach around 2.1% of GDP. The increase is driven by the projected full phasing out of the measures to mitigate the impact of high energy prices, implemented until June 2023.

The debt-to-GDP ratio is forecast to decrease over the coming years on the back of projected nominal GDP growth (including due to the high GDP deflator) and primary surpluses. It is set to reach 80.4% by the end of 2023, and further decline to 72.5% in 2024, down from 86.5% in 2022.

Risks to the fiscal outlook are tilted to the downside. In particular, the planned expansion of the state-owned asset management company KEDIPES and a potential amendment to the wage indexation system could negatively affect public finances.

Details

- Publication date

- 15 May 2023

- Author

- Representation in Cyprus